Estimated tax calculator 2020

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right. It is mainly intended for residents of the US.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Your household income location filing status and number of personal exemptions.

. All Available Prior Years Supported. Based upon IRS Sole Proprietor data as of 2020 tax year. IRS tax forms.

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. Enter your filing status income deductions and credits and we will estimate your total taxes.

0 Estimates change as we learn more about you Income 000 - Deductions 1255000 Tax Bracket 10 Effective Tax Rate 0 Basic For Simple tax returns only Start for Free Pay only when you file. Free tax calculators and tools. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Get every tax deduction youre entitled to. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS the following April. Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. We can also help you understand some of the key factors that affect your tax return estimate. 1040 Tax Estimation Calculator for 2020 Taxes.

This means that 50 of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27 2020 and ending December 31 2020 is not used to calculate the installments of estimated tax due. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. RapidTax 2020 Tax Calculator Family Income Deductions and Credits Tell us about yourself How will you be filing your tax return.

Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. And is based on. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

No Tax Knowledge Needed. You Can Do It. And is based on the tax brackets of 2021 and 2022.

Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. Also calculated is your net income the amount you have left. 2020 Simple Federal Tax Calculator.

These rates are the default unless you tell your payroll provider to use a different amount. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. This calculator is for the tax year 2020.

Information and interactive calculators are made available to you as self-help tools for your. Taxable income Your taxable income is your adjusted gross income minus deductions standard or itemized. How Income Taxes Are Calculated.

Does not include self-employment tax for the self-employed. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter. Ad TurboTax Makes It Easy To File Past Years Taxes.

Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. 2020 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Does not include income credits or additional taxes. Estimate your tax refund uncover deductions and credits learn about your pay withholding and more.

Do you have a Valid SSN. We prepare returns quickly accurately. Ad We set up an accounting system audit your books foster growth for your business.

Our calculator uses the IRS standard withholding rates to estimate whats withheld from your paycheck annually. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Enter your income and location to estimate your tax burden.

What You Need Have this ready. This includes a Tax Bracket Calculator W-4 Withholding Calculator Self-Employed Expense Estimator Documents Checklist tool TaxCaster and more. Yes No Are you being claimed as a dependent.

Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widow er What was your age on December 31 2020. Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. Please refer to Publication 505 Tax Withholding and Estimated Tax PDF for additional information.

The withholding rates are designed to create some margin. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way. Free Income Tax Calculator - Estimate Your Taxes - SmartAsset Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator.

Paystubs for all jobs spouse too. Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. The calculator will calculate tax on your taxable income only.

Tax Calculator Estimate Your Income Tax For 2022 Free

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Inkwiry Federal Income Tax Brackets

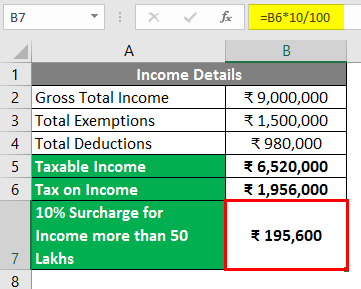

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Federal Income Tax

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

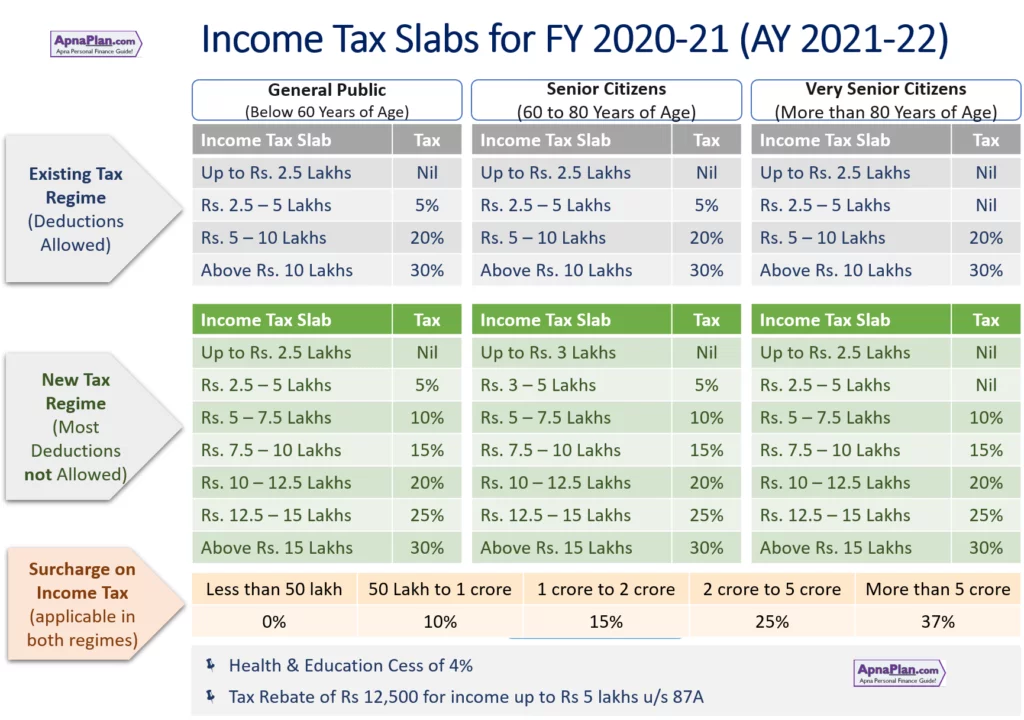

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax